March 14, 2013

Fannie Mae recently introduced an expanded HomePath for Short Sales tool to resolve short sale challenges. The tool, a new short sale escalation process, is open to any real estate professional working on a short sale involving a Fannie Mae-owned loan. Once a case is escalated, Fannie Mae will directly engage with the agent or servicer to address challenges such as when you are ready to list a property and need a recommended list price; you want to contest a value Fannie Mae has assigned to a listed property; you haven’t heard back from the servicer; and/or you have an issue with an offer currently under negotiation.

Contacting Fannie Mae about an Active Short Sale

A Job Aid for Real Estate Professionals

If you are a real estate professional seeking assistance with an active short sale, you have the option of escalating certain issues directly to Fannie Mae to get the answers you need.

When should you contact Fannie Mae about a short sale?

- I’m ready to list a property and need a recommended list price.

- I want to contest a value Fannie Mae has assigned to a listed property.

- I submitted an offer to the servicer more than 20 days ago and have not received acknowledgement of it.

- My request for a valuation has been pending with the servicer for more than 30 days.

- I have not received an acceptance, rejection or counter to an offer I submitted more than 60 days ago.

- I have an issue with an offer.

- I have a question about a Fannie Mae policy related to short sales.

To contact Fannie Mae about a short sale:

- Determine if Fannie Mae owns the loan using our Loan Lookup tool.

- Read about what information you’ll need to provide on the checklist below.

- Ask your client to complete Fannie Mae’s Borrower Authorization Form.

- Submit your short sale issue directly at http://www.homepathforshortsales.com/hpshortsaleinquiry.html

Know What You Need Ahead of Time

Required Information

Before you contact Fannie Mae about a short sale, make sure you have all of the information you need. The information you need depends on the request you are making. Some information is required for Fannie Mae’s dedicated short sale team to be able to help you.

After verifying Fannie Mae owns the loan, Fannie Mae will need your contact information (listing agent name, agency name, phone number, and email), the Fannie Mae and/or servicer loan number, and a completed Fannie Mae Borrower Authorization Form, which you will need to upload when you begin the process.

In addition to this information, here’s what Fannie Mae will ask you for when you inquire about an active short sale. *Note that the information marked with an asterisk is required*

2 Comments |

2 Comments |  real estate | Tagged: active, approve, borrower authorization form, challenge, contact, escalate, fannie mae, inquiry, issue, loan, lookup tool, property, real estate, real estate professionals, resolve, short sale |

real estate | Tagged: active, approve, borrower authorization form, challenge, contact, escalate, fannie mae, inquiry, issue, loan, lookup tool, property, real estate, real estate professionals, resolve, short sale |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

December 4, 2012

Understanding Short Sale Agent Commissions

Bank of America pays commissions to licensed real estate professionals who close acceptable short sale transactions.

Commissions are:

- Allocated from the sale’s proceeds to qualifying real estate agents or attorneys at closing

- Calculated as a percentage based on the total/gross sales price of the property

- Usually divided between the buyer and seller agents, as per mutual agreement

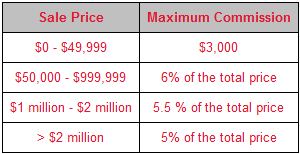

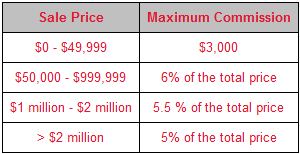

The maximum commission for all acceptable transactions is as follows and is paid when the short sale reflects positive mitigation:

Flexibility is allowed in the commission structure when the short sale does not reflect positive mitigation* or if the minimum acceptable net proceed** is not met. In these circumstances, the real estate agent may choose to reduce his/her commission to meet minimum mitigation requirements.

Exceptions:

- Dual agents unrelated to either party will receive a 4% commission

- In some situations, commission is limited per investor guidelines/investor approval and may vary

Acceptable and Unacceptable Short Sale Transactions

In an acceptable transaction, commissions will always be paid within the following guidelines:

* Positive mitigation is the amount of loss Bank of America will mitigate by accepting the short sale as opposed to foreclosure.

** Minimum acceptable net proceed is the amount the investor requires to complete the short sale transaction.

An eligible short sale transaction is made on an arm’s-length basis, meaning the buyer and the seller have no personal, familial or professional (business associate, business interest) relationship and the property is listed for sale on the open market at fair market value. There may not be any actual or implied conflicts of interest.

If you have questions, first contact your short sale specialist (or closing officer) through Equator messaging. If there’s no response after two days, escalate to the team lead.

For urgent needs (such as a foreclosure postponement) or for escalation beyond the team lead, contact Short Sale Customer/Agent Care at 1.866.880.1232 between 8 a.m. – 10 p.m. (EST), Mon- Fri, and 9 a.m. – 5:30 p.m. (EST), Sat.

Leave a Comment » |

Leave a Comment » |  real estate | Tagged: agent, bank of america, commission, guidelines, property, real estate, short sale, update |

real estate | Tagged: agent, bank of america, commission, guidelines, property, real estate, short sale, update |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

May 3, 2010

In Announcement SEL-2010-05, Fannie Mae updated several policies regarding the future eligibility of borrowers to obtain a new mortgage loan after experiencing a preforeclosure event (preforeclosure sale, short sale, or deed-in-lieu of foreclosure).

The “waiting period” – the amount of time that must elapse after the preforeclosure event – is changing and may be dependent on the loan-to-value (LTV) ratio for the transaction and whether extenuating circumstances contributed to the borrower’s financial hardship (for example, loss of employment). In addition, Fannie Mae is updating the requirements for determining that borrowers have re-established their credit after a significant derogatory credit event.

***Note: The terms “short sale” and “preforeclosure sale” both referenced in the Announcement have the same meaning – the sale of a property in lieu of a foreclosure, resulting in a payoff of less than the total amount owed, which was pre-approved by the servicer.***

Waiting Period After a Preforeclosure Sale, Short Sale, or Deed-in-Lieu of Foreclosure

Fannie Mae is changing the required waiting period for a borrower to be eligible for a mortgage loan after a preforeclosure event. The waiting period commences on the completion date of the preforeclosure event, and may vary based on the maximum allowable LTV ratios.

| Preforeclosure Event |

Current Waiting Period Requirements |

New Waiting Period Requirements(1) |

| Deed-in-Lieu of Foreclosure |

4 years |

2 years – 80% maximum LTV ratios, 4 years – 90% maximum LTV ratios, 7 years – LTV ratios per the Eligibility Matrix |

| Short Sale |

2 years |

| Exceptions to Waiting Period for Extenuating Circumstances |

| Preforeclosure Event |

Current Waiting Period Requirements |

New Waiting Period Requirements (1) |

| Deed-in-Lieu of Foreclosure |

2 years Additional requirements apply after 2 years up to 7 years |

2 years – 90% maximum LTV ratios |

| Short Sale |

No exceptions are permitted to the 2-year waiting period |

(1) The maximum LTV ratios permitted are the lesser of the LTV ratios in this table or the maximum LTV ratios for the transaction per the Eligibility Matrix.

Bankruptcies

The multiple bankruptcy policy is being clarified to state that 2 or more borrowers with individual bankruptcies are not cumulative. For example, if the borrower has one bankruptcy and the co-borrower has one bankruptcy, this is not considered a multiple bankruptcy. The current waiting periods for bankruptcies remain unchanged.

Effective Date

This policy is effective for beginning July 1, 2010.

Requirements for Re-Establishing Credit

The requirements for borrowers to re-establish their credit after a significant derogatory event are also being updated. Fannie Mae is replacing the requirements related to the number of credit references and applicable payment histories with the waiting periods and other criteria.

After a bankruptcy, foreclosure, deed-in-lieu of foreclosure, or preforeclosure or short sale, the borrower’s credit will be considered re-established if all of the following are met:

- The waiting period and the related requirements are met.

- The loan meets the minimum credit score requirements based on the parameters of the loan and the established eligibility requirements.

The “Catch”?

Now to qualify after that 2 year period, the new regulations state that a minimum 20% down payment will be required; 10% for a down payment, the wait will revert to the 4 year minimum; less than 10% for a down payment, the wait could be even longer — UNLESS there are “extenuating circumstances” such as job loss, health problems, divorce, etc…

But doesn’t pretty much any short sale by default involve “extenuating circumstances”? Just show them the hardship letter you submitted with your short sale docs. Case closed.

Why This Matters?

So why does this matter, and how should you, as distressed homeowners, USE this information?

Well for starters, if you couple this with the Obama administration’s new short sale assistance program (where mortgage servicing companies are paid $1,000 to handle successful short sales and mortgage holders get $1,500 for signing over their property), you’ve now got more compelling reasons than ever to pursue a short sale rather than just throwing up your hands and “letting things go”.

Leave a Comment » |

Leave a Comment » |  real estate | Tagged: additional, after, allow, amount, announcement, applicable, apply, approve, bankruptcy, borrowers, buy, change, circumstances, clarify, compel, complete, contribute, credit, criteria, cumulative, current, date, deed-in-lieu, default, dependent, derogatory, determine, distress, divorce, documents, down, effective, elapse, eligibility, eligible, employment, established, event, example, exception, experience, extenuating, fannie, financial, follow, foreclosure, go, hardship, harship, health, history, home, homeowners, individual, information, involve, job, less, lesser, letter, letting, loan, longer, loss, ltv, matrix, matters, maximum, meet, minimum, mortgage, multiple, new, no, number, obtain, owe, parameters, payment, payoff, period, permit, policy, preforeclosure, problems, property, qualify, ration, reasons, reference, regulations, relate, remain, replace, requirements, result, revert, sale, score, servicers, short sale, significant, state, submit, table, things, time, total, transaction, update, waiting, years |

real estate | Tagged: additional, after, allow, amount, announcement, applicable, apply, approve, bankruptcy, borrowers, buy, change, circumstances, clarify, compel, complete, contribute, credit, criteria, cumulative, current, date, deed-in-lieu, default, dependent, derogatory, determine, distress, divorce, documents, down, effective, elapse, eligibility, eligible, employment, established, event, example, exception, experience, extenuating, fannie, financial, follow, foreclosure, go, hardship, harship, health, history, home, homeowners, individual, information, involve, job, less, lesser, letter, letting, loan, longer, loss, ltv, matrix, matters, maximum, meet, minimum, mortgage, multiple, new, no, number, obtain, owe, parameters, payment, payoff, period, permit, policy, preforeclosure, problems, property, qualify, ration, reasons, reference, regulations, relate, remain, replace, requirements, result, revert, sale, score, servicers, short sale, significant, state, submit, table, things, time, total, transaction, update, waiting, years |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

April 19, 2010

On April 8, 2010, Bank of America (BOA) executives held a webinar presentation for over 10,000 Realtors to discuss BOA’s short sale process.

Tip: Refer to the Equator Agent/Homeowner Guide for step-by-step instructions

Summary

10 Tips to Avoid Delays in Processing Time

- Review all documents and images for accuracy prior to uploading in Equator

- Ensure that property is listed in the MLS

- Negotiate external party fees prior to submission of HUD-1

- Supply HUD-1 that is valid for at least 60 days

- Ensure that agent and customer tasks are completed as timely as possible in Equator (i.e. accepting short sale assignment, submitting short sale offer, and uploading offer documents within 7 days)

- Only submit fully executed purchase offers with all appropriate addendums signed by both buyer and homeowner

- Work to get purchase offer representing the best possible fair market value and highest net proceeds for the lender

- Set appropriate expectations with buyers/sellers so they understand the complexity and resulting length of time a short sale can take

- Work to get a release on outside liens as early as possible

- The following situations will cause delays: (1) Change in buyer or agent at any time during the process; (2) Customer files bankruptcy; (3) Deal change after the approval letter is issued

Steps Already Taken to Improve the Short Sale Process

- Increased staffing and updated training

- Dedicated Short Sale Call Center: 1-866-880-1232

- Hours of Operation: 8 AM – 9PM (EST), Monday -Friday

- Extended Saturday hours – Coming Soon!

- Equator – primary tool for initiating the short sale

- Changed procedures to improve associate responsiveness

- Enhanced the procedure to proactively provide loan status

Steps Underway to Enhance Programs

Home Affordable Foreclosure Alternatives (HAFA):

- Implemented on April 5, 2010 and are following the HAFA guidelines

- HAFA is first in short sale waterfall of options for a homeowner

- Remember: Some investors (Fannie Mae and Freddie Mac) are not participating; offering a cooperative or traditional short sale

- Proactive outreach to homeowners

- Offering a pre-approved short sale solicitation

- After offer is submitted, approval within 14 days

- Promissory Note – Not required with HAFA

- Homeowner required to clear second liens

- Homeowner leaves the home – no deficiency and no contribution

Cooperative Short Sales:

- Similar in approach to HAFA but wider in scope

- Includes homeowners who are not eligible for HAFA – non-owner occupied, jumbo loans, Fannie, Freddie

- Currently in pilot stages with rollout expected 2nd Quarter of 2010

Steps Underway to Educate Agents

Education Materials:

- Overview of the process so agents can lead process

- Step-by-Step Guidelines for working through the system as an agent and homeowner

- Tips to avoid common problems

Outreach Events to Distribute Materials

- Large Realtor Events

- Webinars

- Participation with Short Sale Certification Programs

Want Agents’ Input

- Developing mechanisms for on-going feedback on process, systems, materials

- Will act on feedback with continuous improvements

Introduction to Equator

- 24/7 access to the short sale system

- Status tracking

- Direct communication with the Short Sale Negotiator

- Documents are uploaded directly to Equator instead of faxing

- Streamlined approval process

- Historical view of offers and counter offers

Coming Soon in Equator:

- There are a few specific loan investor types (i.e., FHA/VA) that are not on the Equator system and will be added at a later date

- Agent feedback, homeowner feedback, and internal data is being leveraged to identify system and/or enhancements for future process rollouts and educational material improvements

Agent Communication within Equator

- Throughout the process you will receive notifications of the status of the short sale. The system automatically tracks the agent, customer, and bank tasks and will alert you after key milestones have been achieved and to let you know the next steps.

- For specific questions/concerns you have, the negotiator assigned to the short sale is your primary contact.

- Please ensure when sending a message in Equator you only select “Negotiator”.

- We request that you only send messages via Equator and not directly through email. This enables our associates to effectively manage the case load and respond to agent inquires in a timely manner.

- If you have submitted a request to the Negotiator via Equator AND there has been no response after 2 business days: You should escalate to a “Team Lead” by selecting this role in your message drop down menu.

- In the event of an urgent issue, such as, a foreclosure sale date within 48 hours: You should immediately escalate to the “Team Lead” and “Manager”; and also call the Short Sale support team at 1-866-880-1232.

5 Comments |

5 Comments |  real estate | Tagged: accept, accuracy, achieve, addendums, affordable, agent, alert, alternatives, america, approach, appropriate, approval, assign, assignment, automatic, avoid, bank, boa, buyer, buyers, call, case, cause, center, change, clear, common, communication, complete, complex, concerns, contribution, cooperative, current, customer, date, deal, dedicate, deficiency, delays, direct, discuss, distribute, documents, educate, effective, eligible, enable, enhance, ensure, equator, escalate, events, execute, expectation, expectations, external, fair, fannie, feedback, fees, file, foreclosure, freddie, guide, guidelines, hafa, homeowners, homes, hud, images, implement, improve, improvements, include, increase, initiate, input, inquiries, instructions, introduction, issue, key, lead, leave, lender, lenders, letter, liens, list, load, loan, manage, manager, market value, materials, message, milestones, MLS, negotiate, negotiator, net, note, notifications, occupy, offer, options, outreach, outside, overview, owner, participate, party, presentation, primary, prior, proactive, problems, procedures, proceeds, process, programs, promissory, property, provide, purchase, questions, real estate, realtors, refer, release, request, require, response, responsiveness, result, review, role, sale, second, select, sellers, send, short sale, sign, situations, solicitation, specific, staff, stages, status, steps, streamlined, submission, submit, supply, support, system, tasks, team, time, timely, tips, tool, track, tracks, traditional, training, understand, update, upload, urgent, valid, webinar, work |

real estate | Tagged: accept, accuracy, achieve, addendums, affordable, agent, alert, alternatives, america, approach, appropriate, approval, assign, assignment, automatic, avoid, bank, boa, buyer, buyers, call, case, cause, center, change, clear, common, communication, complete, complex, concerns, contribution, cooperative, current, customer, date, deal, dedicate, deficiency, delays, direct, discuss, distribute, documents, educate, effective, eligible, enable, enhance, ensure, equator, escalate, events, execute, expectation, expectations, external, fair, fannie, feedback, fees, file, foreclosure, freddie, guide, guidelines, hafa, homeowners, homes, hud, images, implement, improve, improvements, include, increase, initiate, input, inquiries, instructions, introduction, issue, key, lead, leave, lender, lenders, letter, liens, list, load, loan, manage, manager, market value, materials, message, milestones, MLS, negotiate, negotiator, net, note, notifications, occupy, offer, options, outreach, outside, overview, owner, participate, party, presentation, primary, prior, proactive, problems, procedures, proceeds, process, programs, promissory, property, provide, purchase, questions, real estate, realtors, refer, release, request, require, response, responsiveness, result, review, role, sale, second, select, sellers, send, short sale, sign, situations, solicitation, specific, staff, stages, status, steps, streamlined, submission, submit, supply, support, system, tasks, team, time, timely, tips, tool, track, tracks, traditional, training, understand, update, upload, urgent, valid, webinar, work |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

April 9, 2010

Bank of America (BOA) announced last week that it would begin cutting loan balances for distressed mortgage borrowers, and in the process created a lottery – if you’re lucky enough to be in its portfolio and smart enough not to pay your mortgage, you win.

Until now, big lenders and servicers, such as BOA, have only given principal reductions to a microscopic number of borrowers — and only then as a last resort.

But they’re now having to play catch up to a new kind of mortgage servicer — a so-called “specialty servicer” — that is seeing success in avoiding foreclosures.

They handle the worst-of-the-worst, loans at least 90 days late, and one of the tactics they have used is offering principle reductions.

Of course, few mortgages end up in the hands of these speciality servicers, and whether yours lands with one is really just the luck of the draw. But now BoA is taking the practice mainstream, and not surprisingly more loans are going 90 days late.

What are Servicers?

Unlike the person who owns your mortgage, either the bank (rarely) or a group of investors (more common), mortgage servicers are the companies that handle the day-to-day administration of mortgages. They collect payments, maintain escrow accounts and confront borrowers about late payments. They also initiate the foreclosure process when borrowers default.

Most servicer operations were set up in better times, when nearly everyone paid their loans regularly. But when the foreclosure crisis hit, they had to scramble to keep up with the added workload of managing non-performing (bad) loans.

As a result, dozens of specialty services have sprung up to take on these difficult jobs. They mostly deal with loans 3 payments or more late, which is about 5% of all mortgages, according to the Mortgage Bankers Association (MBA).

“Some lenders are so large they can’t handle delinquencies efficiently,” said Rick Smith, CEO of Marix, a specialty servicer. “They’re reaching out to [firms] that specialize in non-performing (bad) loans.”

Plus, he added, companies don’t want to staff up for what is hopefully a temporary problem. “If you hire 500 people to handle it and then the economy improves, then you’re overstaffed by 500,” Smith said.

When can they cut the principal?

Sometimes investors purchase whole portfolios of bad loans. These hedge funds and other groups don’t service the loans themselves and their chief aim is to get the mortgages to pay off again. So they hire one of the specialty servicing firms and give them a lot of leeway to get the loans back on track.

One of their main solutions is cutting the principal balance so that homeowners no longer owe more than their houses are worth.

“Our clients would rather do a principal-reduction than an interest-reduction workout,” said Gagan Sharma, CEO of BSI Financial. “Many bought the loans at discount so they’re happy to pass the savings down to consumers.”

This encourages people to keep paying loans rather than walking away. If property values increase, the owners can turn a profit when they sell.

Conventional servicers have been loathe to cut principal because the investors who actually own the loans don’t want to accept immediate losses and lenders don’t want to encourage more people to press for reductions.

In fact, less than 2% of trial loan modifications under President Obama’s foreclosure-prevention plan, Home Affordable Modification Program (HAMP), have cut the balance owned.

Loan Balance cut in half

It doesn’t always work out so smoothly, however, because borrowers are hesitant to return phone calls or answer letters; sometimes they think the servicers are a scam.

“We have a hard time getting people to respond,” said Vicki Lester, president of Mortgage Servicing at RoundPoint. “Borrowers are still in denial.”

To get to people they start with a call campaign and then they mail out welcome letters and information packets. “Where all else fails, we send out people to knock on doors,” Lester said.

So, the servicers remind, if you’re lucky enough to win the modification lottery, please answer the phone. Talking to someone could mean cutting your loan balance and saving your home.

Making money on a short sale?

Not every home can be saved and specialty servicers employ strategies other than principal reduction. For example, short sales — often with a twist.

Some specialty servicers have a short-sale program in which it pays borrowers a percentage of any price they sell the house for over a “quick sale value.”

For example, if they determine that a normal market value for a house is $200,000 but to sell it quickly the price would have to be $180,000, they give the borrower 3 months to sell the house for whatever he or she can get.

The servicers share with the borrowers anything over the quick sale price. Borrowers may keep 30%, even 40%, of the overage.

Summary

Now that BoA has made the practice widely known, we can expect a lot more lottery winners. So it seems that BOA is implying that if you don’t like the terms of your mortgage, just stop paying!

2 Comments |

2 Comments |  real estate | Tagged: account, affordable, answer, avoid, bad, balance, bank, bank of america, borrowers, call, campaign, collect, crisis, cut, default, delinquent, denial, difficult, discount, distress, doors, efficient, foreclosure, hesitant, homeowners, houses, increase, information, initiate, interest, investors, jobs, keep, knock, late, lenders, letters, loan, loan servicers, loss, lottery, lucky, mail, manage, market value, modification, money, mortgage, non-performing, offer, overage, pay, payments, percentage, phone, portfolio, practice, price, principal, problem, process, profit, program, property, quick, reductions, remind, respond, sale, save, savings, scam, sell, service, servicers, share, short sale, smart, speciality, standards, stop, strategy, success, temporary, value, values, welcome, winner, workload, workout, worst |

real estate | Tagged: account, affordable, answer, avoid, bad, balance, bank, bank of america, borrowers, call, campaign, collect, crisis, cut, default, delinquent, denial, difficult, discount, distress, doors, efficient, foreclosure, hesitant, homeowners, houses, increase, information, initiate, interest, investors, jobs, keep, knock, late, lenders, letters, loan, loan servicers, loss, lottery, lucky, mail, manage, market value, modification, money, mortgage, non-performing, offer, overage, pay, payments, percentage, phone, portfolio, practice, price, principal, problem, process, profit, program, property, quick, reductions, remind, respond, sale, save, savings, scam, sell, service, servicers, share, short sale, smart, speciality, standards, stop, strategy, success, temporary, value, values, welcome, winner, workload, workout, worst |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

March 30, 2010

What is Fannie Mae’s Alternative Modification™ (Alt Mod™)?

The Alt Mod is an alternative to the Home Affordable Modification Program (HAMP) modification for those borrowers who were eligible for and accepted into a HAMP trial period plan but were subsequently not offered a HAMP permanent modification because of eligibility restrictions.

Are servicers required to offer the Alt Mod?

Yes, for mortgage loans in active HAMP trials initiated prior to March 1, 2010, all Fannie Mae-approved servicers must consider the Alt Mod prior to the initiation of foreclosure for all eligible borrowers who were not offered a permanent HAMP modification after making all required payments under a HAMP trial period plan. All borrowers must meet the eligibility criteria outlined below.

What are the benefits of an Alt Mod?

An Alt Mod offers you a permanent long-term solution to make your mortgage more affordable.

If I didn’t qualify for a permanent modification under HAMP, will I qualify for an Alt Mod?

The requirements for an Alt Mod have been designed specifically to assist borrowers, who were unable to qualify for a permanent modification through HAMP. If borrowers made their HAMP Trial Period Plan payments and have completed the HAMP Trial Period Plan, borrowers are likely a candidate for an Alt Mod. Once the servicer has the borrower’s required information, the servicer will review to see if the borrowers are eligible.

How do I qualify for Alt Mod/What do I need to do to get approved?

To begin the qualification process, review the Alt Mod Loan Modification Agreement and the Hardship Affidavit and return back to the servicer by the specified date.

Why do I need to sign another Loan Modification Agreement…I already did this for HAMP?

Alt Mod is a new loan modification option offered by Fannie Mae (the owner of your loan). It is not a part of the government’s loan modification program, HAMP. The Alt Mod was created for borrowers who were not approved for HAMP. The borrowers’ terms and payment amount should be the same as that of HAMP. All eligible borrowers who want to accept the terms of an Alt Mod, must read, agree, and sign a new Loan Modification Agreement.

I am currently paying the trial period payment that was specified under HAMP. Do I keep paying this same amount? Will my payment change if I get an Alternative Modification?

Yes, keep paying the same payment amount you were paying during the HAMP Trial Period. If you are eligible for an Alternative Modification, your payment should stay the same. The Alt Mod Loan Modification Agreement will specify your payment amount and when your payments are due.

When are my payments due?

If you are eligible for an Alternative Modification, you will sign an Alt Mod Loan Modification Agreement which specifies your payment amount and the day each month that your payment is due.

Is there a trial period I have to complete?

No. There is no trial period for Alt Mod. If you are eligible for an Alt Mod, once approved and the Loan Modification Agreement completed, your loan will be permanently modified.

Will I still receive the incentive compensation offered through the HAMP program?

No. An Alt Mod does not offer an incentive compensation for borrowers. The borrower incentive compensation is only available to borrowers who were eligible/qualified for a permanent modification under HAMP.

Is the Alt Mod a temporary servicing policy change?

Yes, Alt Mod cases must be submitted through the HomeSaver Solutions® Network (HSSN) prior to the final date of the program offering, August 31, 2010.

Which Fannie Mae loans are eligible for an Alt Mod?

All conventional mortgage loans held in Fannie Mae’s portfolio and mortgage loans that are part of an MBS pool that has the special servicing option or a shared-risk MBS pool for which Fannie Mae markets the acquired property.

Who qualifies are an Alt Mod?

To be eligible for the Alt Mod:

- The loan must have been evaluated and considered eligible for HAMP

- The HAMP trial period must have been initiated prior to March 1, 2010

- The loan must be secured by a 1- 4 unit owner-occupied property

- The borrower must have made all required payments in accordance with a HAMP trial period plan, including subsequent payments that may have been due while the servicer attempted to convert the trial period to a permanent modification

- Any subsequent trial period payment(s) due from the borrower must be submitted prior to executing a permanent modification agreement

Additionally, one of the following is required for Alt Mod eligibility:

- The monthly mortgage payment ratio based on verified income was less than 31%

- The target monthly mortgage payment ratio of 31% based on verified income could not be reached using the standard HAMP modification waterfall

- The borrower failed to provide all income documentation required for a HAMP modification but meets the streamlined income documentation requirements for the Alt Mod as described below

What are the underwriting guidelines for an Alt Mod?

A servicer must have a property valuation as required for HAMP in Announcement 09-05R. The servicer must use that valuation to underwrite the Alt Mod.

For loans with a current mark-to-market loan-to-value (LTV) of 80% or greater (LTV ratio based upon the HAMP valuation), the payment calculated for HAMP using the standard modification waterfall should be used for the Alt Mod, and verification of income documentation (as described below) is not necessary.

For loans with a current mark-to-market LTV ratio of less than 80%, the payment calculated for HAMP using the standard modification waterfall should be used for the Alt Mod and income verification is required (as described below). However, the Alt Mod mortgage payment may not be reduced below 20% of the borrower’s verified monthly gross income.

- If the borrower did not qualify for a HAMP modification because the borrower failed to provide all required income documentation but the income documentation meets the streamlined income documentation requirements for the Alt Mod, the servicer may use the payment previously calculated for the HAMP trial period for the Alt Mod provided that the payment meets the criteria outlined above.

- If, after applying the modification waterfall steps based on verified income documentation, the borrower’s monthly mortgage payment cannot be reduced without going below a 20% monthly mortgage payment ratio, the servicer may not perform the modification without the express written consent of Fannie Mae. A principal write-down or principal forgiveness is prohibited on Fannie Mae mortgage loans.

What are the Alt Mod income verification requirements for loans with current mark-to-market LTV ratios less than 80%?

A servicer may use the verified income documentation required under HAMP to calculate the payment for the Alt Mod. If the borrower is ineligible for a HAMP modification because of failure to provide the required income documentation, the servicer may rely upon the following streamlined documentation requirements for the Alt Mod.

If the borrower is employed: A copy of the most recent paystub indicating year-to-date earnings or if year-to-date earnings are not available, copies of paystubs for the last two months.

If the borrower elects to use other earned income such as bonus, commission, fee, housing allowance, tips, overtime: Reliable third party documentation describing the nature of the income (for example, an employment contract or printouts documenting tip income).

If the borrower is self-employed: A signed copy of the most recent federal income tax return, including all schedules and forms, if available, or signed Internal Revenue Service (IRS) Request for Transcript of Tax Return (Form 4506-T); and copies of bank statements for the business account for the last two months to document continuation of business activity.

If the borrower elects to use alimony or child support income to qualify, acceptable documentation includes: Photocopies of the divorce decree, separation agreement or other type of legal written agreement or court decree that provides for the payment of alimony or child support and states the amount of the award and the period of time over which it will be received; and documents supplying reasonably reliable evidence of full, regular, and timely payments, such as bank deposit slips or bank statements for the last two months.

If the borrower has other income such as Social Security, disability or death benefits, a pension, public assistance or adoption assistance: Acceptable documentation includes letters, exhibits, a disability policy or benefits statement from the provider that states the amount, frequency and duration of the benefit; and the servicer must obtain copies of the most recent bank statement showing these deposits.

If the borrower receives unemployment: Acceptable documentation includes letters, exhibits or a benefits statement from the provider that states the amount, frequency, and duration of the benefit. The servicer must have determined that the income will continue for at least 9 months from the date of the HAMP eligibility determination.

If the borrower has rental income, acceptable documentation includes: Copies of all pages from the borrower’s signed federal income tax return and Schedule E – Supplemental Income and Loss, for the most recent tax year.

- When Schedule E is not available because the property was not previously rented, servicers may accept a current lease agreement and bank statements or cancelled rent checks.

- If the borrower has rental income from a 1 – 4 unit property that is also the borrower’s principal residence, the monthly net rental income to be calculated for HAMP purposes must equal 75% of the gross rent, with the remaining 25% being considered vacancy loss and maintenance expense.

- If the borrower has rental income from a property that is other than the borrower’s primary residence, the income should be 75% of the monthly gross rental income, reduced by the monthly debt service on the property (i.e., principal, interest, taxes, insurance, including mortgage insurance and association fees, if applicable

Income documentation previously obtained during the HAMP evaluation may be relied upon for the purposes of verifying income for the Alt Mod. All other income documentation must not be more than 90 days old from the date of the Alt Mod evaluation.

Is a hardship affidavit required for Alt Mod?

Yes, in all cases a signed hardship affidavit is required. For borrowers that did not provide one under HAMP, a hardship affidavit may be included in the Alt Mod offer package for signature along with the Loan Modification Agreement (Form 3179).

How should servicers treat loans with mortgage insurance?

Fannie Mae is seeking blanket delegations of authority from mortgage insurers so that servicers can more efficiently process Alt Mods without having to obtain mortgage insurer approval on individual loans. Servicers must obtain approval on a case-by-case basis from mortgage insurers that have not provided delegated authority agreements.

Servicers must include the mortgage insurance premium in the borrower’s modified payment and must ensure that any existing mortgage insurance is maintained. Servicers must maintain their mortgage insurance processes and comply with all reporting required by the mortgage insurer for Alt Mod loans.

What are the escrow requirements for Alt Mod?

All of the borrower’s trial period payments under HAMP as well as the payments due under the Alt Mod must include a monthly escrow amount unless prohibited by applicable law.

What are the messaging requirements for the Alt Mod offer from servicers to borrowers?

- Clearly indicate that, while the Alt Mod contains the same payment terms as the HAMP modification, the borrower did not meet the requirements of HAMP and as a result, the Alt Mod does not include borrower incentive payments that are otherwise payable under HAMP

- Provide the borrower with a simplified Summary of the Loan Modification Agreement

- Inform the borrower that, in the event of re-default, the servicer will pursue liquidation options

- Remind the borrower of the consequences of material misstatements when submitting documentation in connection with a request for a loan modification

What are the timing expectations for Alt Mod offers?

For qualified borrowers who are already identified as ineligible for a permanent HAMP Modification, Alt Mod offers should be sent no later than 30 days from the date of Lender Letter LL-2010-04. Going forward, for other borrowers who: 1) entered into a trial period plan prior to March 1, 2010, 2) fail to qualify for a permanent HAMP modification, and 3) are determined to be eligible for Alt Mod, offers should be sent within 10 days of completion of the trial periods and expiration of the 30-day HAMP Borrower Notice. All Alt Mod offers should also include an expiration date of 30 days from the date of the offer

For borrowers who do not respond to the Alt Mod offer, servicers must conduct follow-up:

- Between the fifth and the 15th days after the offer is mailed, servicers must attempt at least 3 phone calls.

- On the 15th day after the offer is mailed, servicers must mail a follow-up letter by either mail or a direct contact, door-knocking campaign.

- Between the 15th and 30th day, after the offer is mailed, servicers must attempt to contact the borrower a minimum of 3 additional times regarding the offer by either phone calls and/or use of field servicers (door knockers).

What are the incentive fees for Alt Mod?

A servicer will receive compensation of $800 for each completed modification. Incentive fee payments on eligible mortgage loans will be sent to servicers upon receipt of a closed case entered into HSSN. Servicers need not submit requests for payment of modification incentive fees. Modification incentive fees on eligible mortgages will be sent to servicers on a monthly basis.

Unlike HAMP, there are no borrower incentive payments available with Alt Mod.

How should servicers handle a borrower who re-defaults after receiving an Alt Mod?

If a borrower becomes 60 days delinquent on the Alt Mod within the first 12 months after the effective date of the modification, then the servicer must immediately pursue either a pre-foreclosure sale (short sale), deed-in-lieu (DIL) of foreclosure or commence foreclosure proceedings in accordance with applicable state law. Should a servicer determine that another modification is appropriate for the borrower; the servicer must submit the loan information as a non-delegated case into HSSN for Fannie Mae’s prior approval.

10 Comments |

10 Comments |  real estate | Tagged: accept, affidavit, affordable, agreement, alternatives, approval, benefits, borrowers, candidate, complete, consider, criteria, deed-in-lieu, default, delinquent, documentation, eligibility, fannie, financial, foreclosure, form, guidelines, hardship, help, home value, homeowners, homes, income, ineligible, information, irs, liquidation, loan, loan servicers, ltv, market value, modification, mortgage, notice, options, payment, permanent, plan, process, program, property, qualify, ratio, requirements, restrictions, review, short sale, solution, summary, target, tax, terms, trial, underwriting, valuation, verify |

real estate | Tagged: accept, affidavit, affordable, agreement, alternatives, approval, benefits, borrowers, candidate, complete, consider, criteria, deed-in-lieu, default, delinquent, documentation, eligibility, fannie, financial, foreclosure, form, guidelines, hardship, help, home value, homeowners, homes, income, ineligible, information, irs, liquidation, loan, loan servicers, ltv, market value, modification, mortgage, notice, options, payment, permanent, plan, process, program, property, qualify, ratio, requirements, restrictions, review, short sale, solution, summary, target, tax, terms, trial, underwriting, valuation, verify |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

March 29, 2010

In Lender Letter LL-2010-04, Fannie Mae introduces the Alternative Modification™ (Alt Mod™), an alternative to the HAMP modification for those borrowers who were eligible for and accepted into a HAMP trial period plan but were subsequently not offered a HAMP permanent modification because of eligibility restrictions.

For mortgage loans in active HAMP trial period plans initiated prior to March 1, 2010, all Fannie Mae-approved servicers must consider the Alt Mod prior to the initiation of foreclosure for all eligible borrowers who were not offered a permanent HAMP modification after making payments under a HAMP trial period plan. All borrowers must meet the eligibility criteria outlined below.

A borrower that entered into a trial period plan prior to March 1, 2010 will be considered eligible for the Alt Mod as long as the case is submitted through the HomeSaver Solutions® Network (HSSN) prior to the final date of the program offering, August 31, 2010.

Eligibility

To be eligible for the Alt Mod, the mortgage loan must first have been evaluated and considered eligible for HAMP as described in Announcement 09-05R, including confirmation that the mortgage loan is secured by a 1 – 4 unit owner-occupied property. The HAMP trial period must have been initiated prior to March 1, 2010. The borrower must have made all required payments in accordance with a HAMP trial period plan, including subsequent payments that may have been due while the servicer attempted to convert the trial period to a permanent modification. Any subsequent trial period payment(s) due from the borrower must be submitted prior to executing a permanent modification agreement.

The Alt Mod may be considered if:

- the monthly mortgage payment ratio based on verified income was less than 31%,

- the target monthly mortgage payment ratio of 31% based on verified income could not be reached using the standard HAMP modification waterfall, or

- the borrower failed to provide all income documentation required for a HAMP modification but the income documentation meets the streamlined income documentation for the Alt Mod (described in the Underwriting section below).

When a borrower is considered eligible for the Alt Mod, the servicer must:

- document the borrower’s file to evidence compliance with the requirements for resolving active trial modifications in accordance with Announcement SVC-2010-03,

- cancel the HAMP modification in HSSN and the Treasury Department’s system of record, and

- send the borrower the appropriate Borrower Notice as outlined in Announcement 09-36. The servicer must include the Alt Mod offer and Loan Modification Agreement (Form 3179) with the HAMP Borrower Notice when possible.

The Alt Mod offer must clearly indicate that, while the Alt Mod contains the same payment terms as the HAMP modification, the borrower did not meet the requirements of HAMP and as a result, the Alt Mod does not include borrower incentive payments that are otherwise payable under HAMP.

Before any permanent modification can become effective, the servicer must:

- provide the borrower with a simplified summary of the Loan Modification Agreement (Instructions for Form 3179),

- inform the borrower that in the event of re-default the servicer will pursue liquidation options, and

- remind the borrower of the consequences of material misstatements when submitting documentation in connection with a request for a modification.

Timing of Borrower Solicitation & Follow-Up

For qualified borrowers who are already identified as ineligible for a permanent HAMP modification, Alt Mod offers should be sent no later than 30 days from the date of this Lender Letter.

Going forward, for other borrowers who entered into a trial period plan prior to March 1, 2010 and failed to qualify for a permanent HAMP modification, but are determined to be eligible for Alt Mod, offers should be sent within 10 days of completion of the HAMP trial period and expiration of the 30-day HAMP Borrower Notice. All Alt Mod offers should also include an expiration date of 30 days from the date of the offer.

For borrowers who do not respond after the Alt Mod offer has been sent, servicers must conduct follow-up:

- between the 5th and the 15th day after the offer is mailed, servicers must attempt at least 3 phone calls;

- on the 15th day after the offer is mailed, servicers must deliver a follow-up letter, by either mail or a direct contact, door-knocking campaign; and

- between the 15th and 30th day after the offer is mailed, servicers must attempt to contact the borrower a minimum of three additional times by either phone calls or the use of field services (door knockers).

Failure to comply with these guidelines could result in forfeiture of incentive payments to the servicer.

Underwriting

A servicer must have obtained a property valuation as required under the HAMP modification as described in Announcement 09-05R. The servicer must use that valuation to underwrite the Alt Mod.

Mark-to-Market LTV 80 Percent or Greater

If the current mark-to-market loan-to-value (LTV) ratio (current LTV based upon the new valuation) is 80% or greater, the payment calculated for HAMP using the standard modification waterfall should be utilized for the Alt Mod and verification of income documentation as described below is not necessary.

Mark-to-Market LTV Less than 80%

When the current mark-to-market LTV ratio is less than 80%, the payment calculated for HAMP using the standard modification waterfall should be utilized for the Alt Mod, and income verification is required (as described in the Streamlined Income Documentation section below). However, the Alt Mod mortgage payment may not be reduced below 20% of the borrower’s verified monthly gross income.

- If the borrower did not qualify for a HAMP modification because the borrower failed to provide all required income documentation but the income documentation meets the streamlined income documentation requirements for the Alt Mod, the servicer may use the payment previously calculated for the HAMP trial period for the Alt Mod provided that the payment meets the criteria outlined above.

If, after applying the modification waterfall steps based on verified income documentation, the borrower’s monthly mortgage payment cannot be reduced without going below a 20% monthly mortgage payment ratio, the servicer may not perform the modification without the express written consent of Fannie Mae. A principal write-down or principal forgiveness is prohibited on Fannie Mae mortgage loans.

Streamlined Income Documentation

A servicer may use the verified income documentation required under HAMP to calculate the payment for the Alt Mod. If the borrower is ineligible for a HAMP modification because of failure to provide the required income documentation, the servicer may rely upon the following streamlined documentation requirements for the Alt Mod.

If the borrower is employed:

- a copy of the most recent paystub indicating year-to-date earnings or, if year-to-date earnings are not available, copies of paystubs for the last two months.

If the borrower elects to use other earned income such as bonus, commission, fee, housing allowance, tips, overtime:

- reliable third party documentation describing the nature of the income (for example, an employment contract or printouts documenting tip income).

If the borrower is self-employed:

- a signed copy of the most recent federal income tax return, including all schedules and forms, if available, or signed Internal Revenue Service Request for Transcript of Tax Return (Form 4506-T); and

- copies of bank statements for the business account for the last two months to document continuation of business activity.

If the borrower elects to use alimony or child support income to qualify, acceptable documentation includes:

- photocopies of the divorce decree, separation agreement or other type of legal written agreement or court decree that provides for the payment of alimony or child support and states the amount of the award and the period of time over which it will be received; and

- documents supplying reasonably reliable evidence of full, regular, and timely payments, such as bank deposit slips or bank statements for the last two months.

If the borrower has other income such as Social Security, disability or death benefits, a pension, public assistance or adoption assistance:

- acceptable documentation includes letters, exhibits, a disability policy or benefits statement from the provider that states the amount, frequency and duration of the benefit; and

- the servicer must obtain copies of the most recent bank statement showing these deposits.

If the borrower receives unemployment:

- acceptable documentation includes letters, exhibits or a benefits statement from the provider that states the amount, frequency, and duration of the benefit. The servicer must have determined that the income will continue for at least nine months from the date of the HAMP eligibility determination.

If the borrower has rental income, acceptable documentation includes:

- copies of all pages from the borrower’s signed federal income tax return and Schedule E – Supplemental Income and Loss, for the most recent tax year.

- When Schedule E is not available because the property was not previously rented, servicers may accept a current lease agreement and bank statements or canceled rent checks.

- If the borrower has rental income from a one- to four-unit property that is also the borrower’s principal residence, the monthly net rental income to be calculated for HAMP purposes must equal 75% of the gross rent, with the remaining 25% being considered vacancy loss and maintenance expense.

- If the borrower has rental income from a property that is other than the borrower’s primary residence, the income should be 75% of the monthly gross rental income, reduced by the monthly debt service on the property (i.e., principal, interest, taxes, insurance, including mortgage insurance and association fees, if applicable).

Income documentation previously obtained during the HAMP evaluation may be relied upon for the purposes of verifying income for the Alt Mod. All other income documentation must not be more than 90 days old from the date of the Alt Mod evaluation.

Executing the Modification Agreement

The servicer must prepare a Loan Modification Agreement to document the agreed-upon terms of the modification. Servicers must revise the Loan Modification Agreement by amending the existing paragraph No. 5 (d) in such agreement to reflect that the borrower will not be charged for administrative and processing costs as described in the Administrative Costs section below.

Unless a borrower or co-borrower is deceased or a borrower and co-borrower are divorced, all parties who signed the original note or security instrument, or their duly authorized representative(s), must provide income documentation and execute the modification agreement. If a borrower and a co-borrower are divorced and the property has been transferred to one borrower in the divorce decree, the borrower who no longer has an interest in the property is not required to execute the modification agreement. In cases where a borrower and co-borrower are unmarried and either the borrower or co-borrower relinquish all rights to the property securing the mortgage loan through a recorded quitclaim deed or other document sufficient under applicable state law to transfer title, the non-occupying borrower who has relinquished property rights is not required to provide income documentation or sign the modification agreement.

Servicers are reminded that modification agreements must be signed by an authorized representative of the servicer and must reflect the actual date of signature by the servicer’s representative.

Recording the Modification

For all mortgage loans that are modified pursuant to an Alt Mod, the servicer must ensure that the modified mortgage loan retains its first lien position and is fully enforceable. The modification agreement must be executed by the borrower(s) and, in the following circumstances, must be in recordable form:

- if state or local law requires a modification agreement be recorded to be enforceable;

- if the property is located in the state of New York or Cuyahoga County, Ohio;

- if the amount capitalized is greater than $50,000 (aggregate capitalized amount of all modifications of the mortgage loan completed under Fannie Mae’s mortgage modification alternatives);

- if the final interest rate on the modified mortgage loan is greater than the pre-modified interest rate in effect on the mortgage loan;

- if the remaining term on the mortgage loan is less than or equal to ten years and the servicer is extending the term of the mortgage loan more than ten years beyond the original maturity date; or

- if the servicer’s practice for modifying mortgage loans in the servicer’s portfolio is to create modification agreements in recordable form.

In addition, to retain the first lien position, servicers must:

- Ensure all real estate taxes and assessments that could become a first lien are current especially those for manufactured homes taxed as personal property, personal property taxes, condominium/HOA fees, utility assessments (such as water bills), ground rent and other assessments.

- Obtain a title endorsement or similar title insurance product issued by a title insurance company if

- the amount capitalized is greater than $50,000 (aggregate capitalized amount of all modifications of the mortgage loan completed under Fannie Mae’s mortgage modification alternatives), or

- the final interest rate on the modified mortgage loan is greater than the pre-modified interest rate in effect on the mortgage loan.

Record the executed modification agreement if:

- state or local law requires the modification agreement be recorded to be enforceable,

- the property is located in Cuyahoga County, Ohio,

- the amount capitalized is greater than $50,000 (aggregate capitalized amount of all modifications of the mortgage loan completed under our modification alternatives),

- the remaining term on the mortgage loan is less than or equal to ten years and the servicer is extending the term of the mortgage loan more than ten years beyond the original maturity date, or

- the final interest rate on the modified mortgage loan is greater than the pre-modified interest rate in effect on the mortgage loan.

Redefault

If a borrower becomes 60 days delinquent on the Alt Mod within the first 12 months after the effective date of the modification, then the servicer must immediately work with the borrower to pursue either a preforeclosure sale, deed-in-lieu of foreclosure or commence foreclosure proceedings, in accordance with applicable state law. Should a servicer determine that another modification is appropriate for the borrower; the servicer must submit the loan information as a non-delegated case into HSSN for Fannie Mae’s prior approval.

Late Fees

All late charges, penalties, stop payment fees or similar fees must be waived upon conversion to an Alt Mod.

Administrative Costs

Servicers may not charge the borrower to cover the administrative processing costs incurred in connection with an Alt Mod. The servicer must pay any actual out-of-pocket expenses such as any required notary fees, recordation fees, title costs, property valuation fees, or other allowable and documented expenses. Fannie Mae will reimburse the servicer for allowable out-of-pocket expenses, with the exception of credit report fees, which will not be reimbursed.

Servicer Incentive Compensation

A servicer will receive compensation of $800 for each completed modification. Incentive fee payments on eligible mortgage loans will be sent to servicers upon receipt of a closed case entered into the HSSN. Fannie Mae will review eligibility for the modification incentive fee and make the final determination based on information provided by the servicer; therefore, servicers need not submit requests for payment of modification incentive fees. Modification incentive fees on eligible mortgages will be sent to servicers on a monthly basis.

5 Comments |

5 Comments |  real estate | Tagged: accept, affordable, agreement, alternatives, announcement, appropriate, approval, bank, borrowers, compensation, compliance, confirmation, consent, consequences, consider, costs, covert, deed-in-lieu, delinquent, documentation, eligible, evaluation, evidence, execute, fannie, fees, final, follow-up, foreclosure, gross, guidelines, homes, incentive, income, interest, lender, letter, liquidation, loan, loan servicers, ltv, modification, monthly, mortgage, notice, options, payment, payments, paystub, perform, permanent, plan, program, property, rate, ratio, reduce, request, require, requirements, resolve, restrictions, revise, secured, short sale, simplify, standard, statements, streamlined, summary, target, term, terms, trial, underwriting, valuation, verify |

real estate | Tagged: accept, affordable, agreement, alternatives, announcement, appropriate, approval, bank, borrowers, compensation, compliance, confirmation, consent, consequences, consider, costs, covert, deed-in-lieu, delinquent, documentation, eligible, evaluation, evidence, execute, fannie, fees, final, follow-up, foreclosure, gross, guidelines, homes, incentive, income, interest, lender, letter, liquidation, loan, loan servicers, ltv, modification, monthly, mortgage, notice, options, payment, payments, paystub, perform, permanent, plan, program, property, rate, ratio, reduce, request, require, requirements, resolve, restrictions, revise, secured, short sale, simplify, standard, statements, streamlined, summary, target, term, terms, trial, underwriting, valuation, verify |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

February 1, 2010

On January 28, 2010, the Treasury Department and Department of Housing and Urban Development (HUD) released updated guidance for the mortgage servicers who initiate the modifications and monitor the trial periods. The guidance refines the documentation requirements and other procedures in order to expedite conversions of current trial modifications to permanent ones.

Guidance Details

Supplemental Directive 10-01 provides guidance on two major issues:

- Converting Borrowers in the Temporary Review Period to Permanent Modifications

In December 2009, the Treasury implemented a review period through January 31, 2010 to provide servicers additional time to collect and submit missing documentation for borrowers in trial modifications, to require that borrowers be notified of any missing documents, and to give borrowers an opportunity to dispute and correct any erroneous information in their applications. Today’s guidance clarifies for servicers the proper procedures for conversion of those borrowers who are current on their monthly payments to permanent modifications.

Acknowledgement and Review of Initial Package

Within 10 business days following receipt of an Initial Package, the mortgage servicer must acknowledge in writing the borrower’s request for HAMP participation by sending the borrower confirmation that the Initial Package was received, and a description of the mortgage servicer’s evaluation process and timeline. If the Initial Package is received from the borrower via e-mail, the servicer may e-mail the acknowledgment. Servicers must maintain evidence of the date of receipt of the borrower’s Initial Package in its records.

Within 30 calendar days from the date an Initial Package is received, the mortgage servicer must review the documentation provided by the borrower for completeness. If the documentation is incomplete, the mortgage servicer must send the borrower an Incomplete Information Notice in accordance with the guidance set forth in the “Incomplete Information Notice” section below. If the borrower’s documentation is complete, the servicer must either:

- Send the borrower a Trial Period Plan Notice; or

- Make a determination that the borrower is not eligible for HAMP and communicate this determination to the borrower in accordance with the Borrower Notice guidance provided in Supplemental Directive 09-08.

A single written communication sent within 10 days of receipt of a borrower’s request for HAMP participation may also include, at the mortgage servicer’s discretion, the results of its review of the Initial Package. Mortgage servicers are reminded that Supplemental Directive 09-01 generally prohibits servicers from proceeding with a foreclosure sale for any potentially eligible mortgage loan until the borrower has been evaluated for eligibility under HAMP and has been determined to be ineligible or has declined a trial period plan offer.

Incomplete Information Notice

If the mortgage servicer receives an incomplete Initial Package or needs additional documentation to verify the borrower’s eligibility and income, the servicer must send the borrower an Incomplete Information Notice that lists the additional required verification documentation. The Incomplete Information Notice must include a specific date by which the documentation must be received, which must be no less than 30 calendar days from the date of the notice. If the documents are not received by the date specified in the notice, the servicer must make one additional attempt to contact the borrower in writing regarding the incomplete documents. This additional notice must include the specific date by which the documentation must be received, which must be no less than 15 calendar days from the date of the second notice. If a borrower is unresponsive to these requests for documentation the servicer may discontinue document collection efforts and determine the borrower to be ineligible for HAMP. If the borrower is determined to be ineligible for HAMP, the servicer must communicate this determination to the borrower in accordance with the Borrower Notice guidance provided in Supplemental Directive 09-08.

Trial Period Plan Approval

Within 30 calendar days following receipt of an Initial Package or complete verification documents, the mortgage servicer must complete its verification and evaluate the borrower’s eligibility for HAMP and, if the borrower is qualified, send the borrower a Trial Period Plan Notice. If the borrower is determined to be ineligible for HAMP, the servicer must communicate this determination to the borrower in accordance with the Borrower Notice guidance provided in Supplemental Directive 09-08. Servicers are reminded that Supplemental Directive 09-01 prohibits servicers from initiating a new foreclosure action while a borrower is in a trial period plan.

Consideration for Alternative Loss Mitigation Options

When a borrower is determined to be ineligible for a HAMP modification, the servicer is required to consider that borrower for all other available loss mitigation options, including but not limited to refinance, forbearance, non-HAMP modifications and, to the extent a borrower does not qualify for a home retention alternative, Home Affordable Foreclosure Alternatives (short sales or deeds in lieu of foreclosure) under Supplemental Directive 09-09. As required in Supplemental Directive 09-08, available loss mitigation options should be described in the Non-Approval Notice.

Conversation from Trial to Permanent Modification:

Servicers must use a two-step process for HAMP modifications. Following underwriting and a determination that the borrower qualifies for a HAMP trial modification, servicers will place qualified borrowers in a trial period plan by preparing and sending a Trial Period Plan Notice to the borrower describing the terms of the trial modification and the payment due dates. Borrowers who make all trial period payments timely and who satisfy all other trial period requirements will be offered a permanent HAMP modification.

Step 1 – Trial Period Plan Start

The trial period is 3 months in duration (or longer if necessary to comply with applicable contractual obligations). Borrowers are not required to sign or return the Trial Period Plan Notice. Servicers should retain a copy of the Trial Period Plan Notice in the borrower file and note the date that it was sent to the borrower. Receipt of the first payment due under the trial period plan on or before the last day of the month in which the first payment is due is evidence of the borrower’s acceptance of the trial period plan and its terms and conditions. The effective date of the trial period will be set forth in the trial period plan and is the 1st day of the month in which the first trial period plan payment is due.

Step 2 – Conversion to Permanent

The borrower must be current under the terms of the trial period plan at the end of the trial period to receive a permanent loan modification. “Current” in this context is defined as the borrower having made each required trial period payment by the last day of the month in which it is due.

Borrowers who fail to make current trial period payments are considered to have failed the trial period and are not eligible for a HAMP modification. Servicers are instructed to use good business judgment in determining whether trial period payments were received timely or if mitigating circumstances caused the payment to be late. Exceptions should be documented in the servicing record.

6 Comments |

6 Comments |  loan modification, real estate | Tagged: acknowledge, affordable, application, approval, borrowers, communicate, conversions, deed-in-lieu, determination, dispute, documentation, due date, eligibility, evaluation, exception, foreclosure, guidelines, homes, hud, information, initial, issue, loan, loan servicers, loss mitigation, modification, mortgage, notice, option, participation, payments, permanent, plan, program, qualify, request, requirements, results, review, sale, short sale, supplemental directive, terms, timeline, timely, treasury, trial period, verification |

loan modification, real estate | Tagged: acknowledge, affordable, application, approval, borrowers, communicate, conversions, deed-in-lieu, determination, dispute, documentation, due date, eligibility, evaluation, exception, foreclosure, guidelines, homes, hud, information, initial, issue, loan, loan servicers, loss mitigation, modification, mortgage, notice, option, participation, payments, permanent, plan, program, qualify, request, requirements, results, review, sale, short sale, supplemental directive, terms, timeline, timely, treasury, trial period, verification |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

December 7, 2009

One of the most commonly asked questions about a short sale is how it will impact credit and the ability to purchase a home in the future. Whether you are a buyer, seller or investor, it’s imperative to educate yourself on this all important aspect of credit to become fully informed before making a final decision or in order to assist sellers in determining the right course of action for their financial future.

Here to help sort through the confusion is a quick primer on credit after a short sale vs. foreclosure. Remember, every situation is distinctive so these estimates represent the average experience of most individuals.

Note: Depending on the situation, circumstances may vary.

Average Time to Rebuild Credit to Purchase a Home

- After a foreclosure: 5 – 7 years

- After a foreclosure with extenuating circumstances such as, but not limited to: disability, death of a spouse, etc: 3 – 7 years

- After a Deed in Lieu (DIL) of foreclosure: 4 – 7 years

- After a Short Sale: 0 – 2 years

Other Alternatives

The above averages represent typical buying patterns for those using regular lenders to obtain a conventional loan or government backed loans; private investors are still viable options that enable many people to purchase another home immediately after any type of financial fiasco, including foreclosure. However, mortgage rates tend to be less favorable and requirements more stringent than ever. Just a few years ago it was quite easy to obtain a sub-prime mortgage for a relatively low rate above the preferred status, but today, much of that has changed. While it is still possible to obtain the equivalent of a sub-prime mortgage, be prepared to come up with a much larger down payment and higher overall rates.

Short Sales Win Hands Down

Sellers wishing to minimize damage to their financial future clearly come out ahead when using a short sale but it’s still possible to further decrease the downside by avoiding a 60-day late payment, working closely with the lender to achieve a quick price agreement, and setting aside as much funds as possible for a new loan. In fact, homeowners that maintain a solid payment history and work-out an agreeable short sale deal early may find it desirable to downsize to a new home by setting aside additional funds equal to 20% down. With Private Mortgage Insurance (PMI) and a reduced debt-to-income (DTI) ratio, sellers are finding it possible to take advantage of lowered property values to immediately purchase another home for a fraction of the cost (and debt burden).

Conclusion: It’s a win-win for all involved but, only if you understand the benefits and work aggressively to seal the deal.

*This post has been adapted from Real Estate News & Commentary by Chris McLaughlin

Leave a Comment » |

Leave a Comment » |  real estate | Tagged: agreement, average, avoid, buyer, buying patterns, circumstances, conventional, credit, deal, debt-to-income ratio, deed-in-lieu, disability, down payment, downsize, fiasco, foreclosure, government backed loans, high, home value, homeowners, homes, interest rate, investor, late payment, lenders, loan, mortgage rates, options, price, private investors, private mortage insurance, property, purchase, quick, rebuild, requirements, seller, short sale |

real estate | Tagged: agreement, average, avoid, buyer, buying patterns, circumstances, conventional, credit, deal, debt-to-income ratio, deed-in-lieu, disability, down payment, downsize, fiasco, foreclosure, government backed loans, high, home value, homeowners, homes, interest rate, investor, late payment, lenders, loan, mortgage rates, options, price, private investors, private mortage insurance, property, purchase, quick, rebuild, requirements, seller, short sale |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

September 20, 2009

eModifyMyLoan gives you the tools you need to handle the loan modification process directly with your lender from the comfort of your home, without hiring an expensive modification company. Simply fill out the online form and then e-mail, fax, or print out and deliver your eModifyMyLoan package to your lender for consideration.

Why Pay a Loan Modification Company Thousands of Dollars When You Can Do it Yourself?

Struggling to make your mortgage payment? Then negotiate a lower payment with your lender. With eModifyMyLoan, you can create a complete loan modification package for your lender in less than an hour. YOU DON’T PAY UNLESS YOU ARE 100% SATISFIED. IF YOU’RE NOT COMPLETELY SATISFIED, THEN IT’S FREE.

Why Choose eModifyMyLoan

If you are looking for a way to lower your monthly mortgage payments or avoid foreclosure through a short sale negotiation, you have three basic options:

- Pay a professional

- Research and submit the information yourself

- Use eModifyMyLoan to generate the required paperwork

Which Solution is Right for You?

Some consumers turn to attorneys or loan modification companies to help them through the process. On average, you can expect a $3,000 fee to process your paperwork, which will include creating the documents and representing you with the lender. There is no guarantee of success and many lenders do not treat the paperwork submitted by these organizations with any more priority than they do the documents submitted by individual homeowners.

Some consumers have opted to attempt the process on their own and have quickly become frustrated and overwhelmed. Because many lenders are swamped with phone calls regarding loan modifications and short sales, they often do not return calls from borrowers, even though they may be on the brink of falling behind on their payments. Some banks have limited days and hours of when you can call and request loan modification companies, while others prioritize their responses to only homeowners that are seriously delinquent or verging on foreclosure. As a result, if you are struggling financially but have not yet fallen behind on payments, you may never receive a return call.

The third option is to use eModifyMyLoan. With the online solution, you are guided through a series of questions to easily create the proper loan modification package and calculate the mortgage payment that you can afford. By supplying the lender with the complete eModifyMyLoan package with all of the necessary paperwork, including your personal finance statement and hardship letter, you increase your chances of more quickly achieving your goal of easing financial pressure. Cost to purchase is $129. Plus, it is backed by a 120-day guarantee.

Choose eModifyMyLoan today for an affordable way to undertake the otherwise daunting task of improving your financial situation with a loan modification or short sale.

Leave a Comment » |

Leave a Comment » |  real estate | Tagged: affordable, banks, delinquent, finance statement, financial situation, foreclosure, hardship letter, homeowners, homes, lenders, loan, modification, mortgage, negotiate, paperwork, payment, plan, short sale |

real estate | Tagged: affordable, banks, delinquent, finance statement, financial situation, foreclosure, hardship letter, homeowners, homes, lenders, loan, modification, mortgage, negotiate, paperwork, payment, plan, short sale |  Permalink

Permalink

Posted by teamworkprogram

Posted by teamworkprogram

Posted by teamworkprogram

Posted by teamworkprogram